Travel Expenses Reimbursement Email

15 subjects and their families were reimbursed for travel expenses.

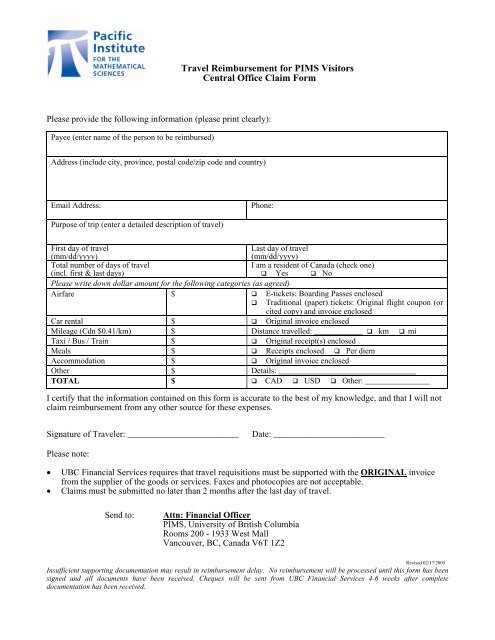

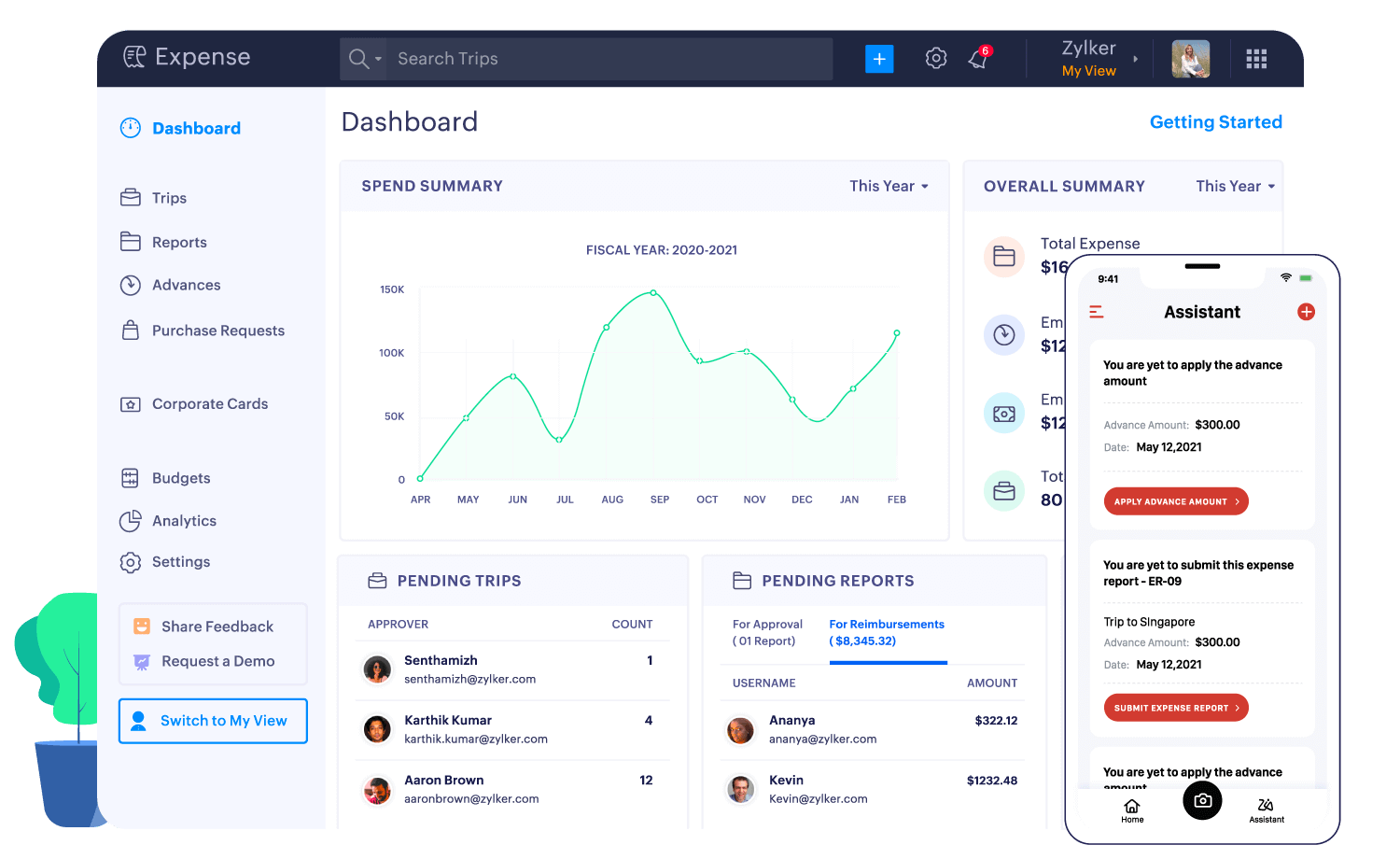

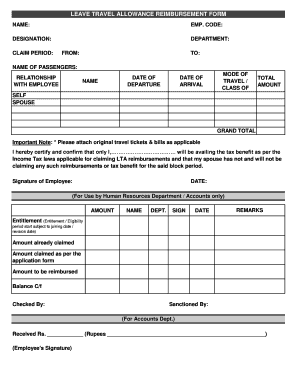

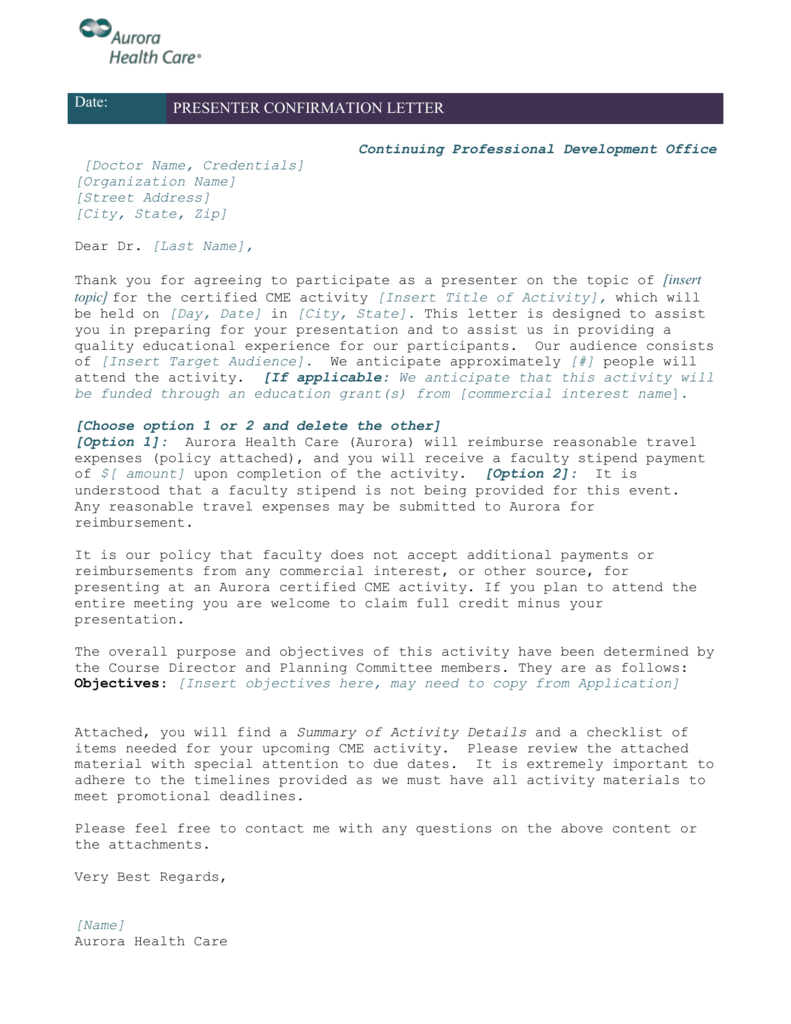

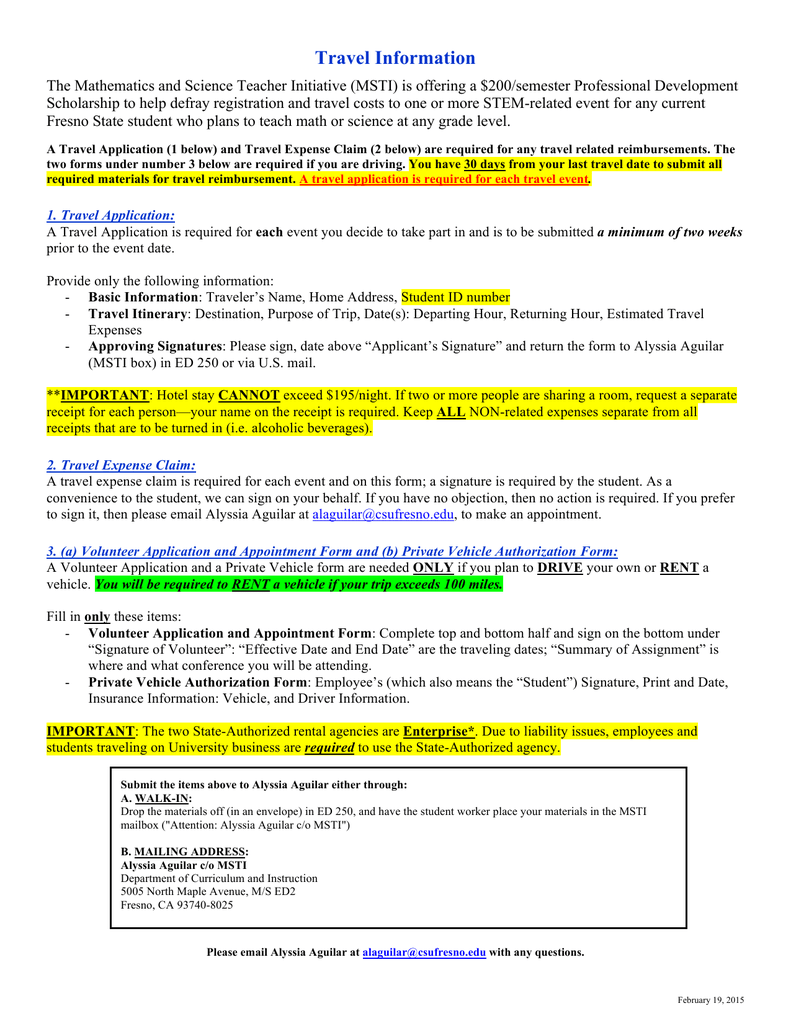

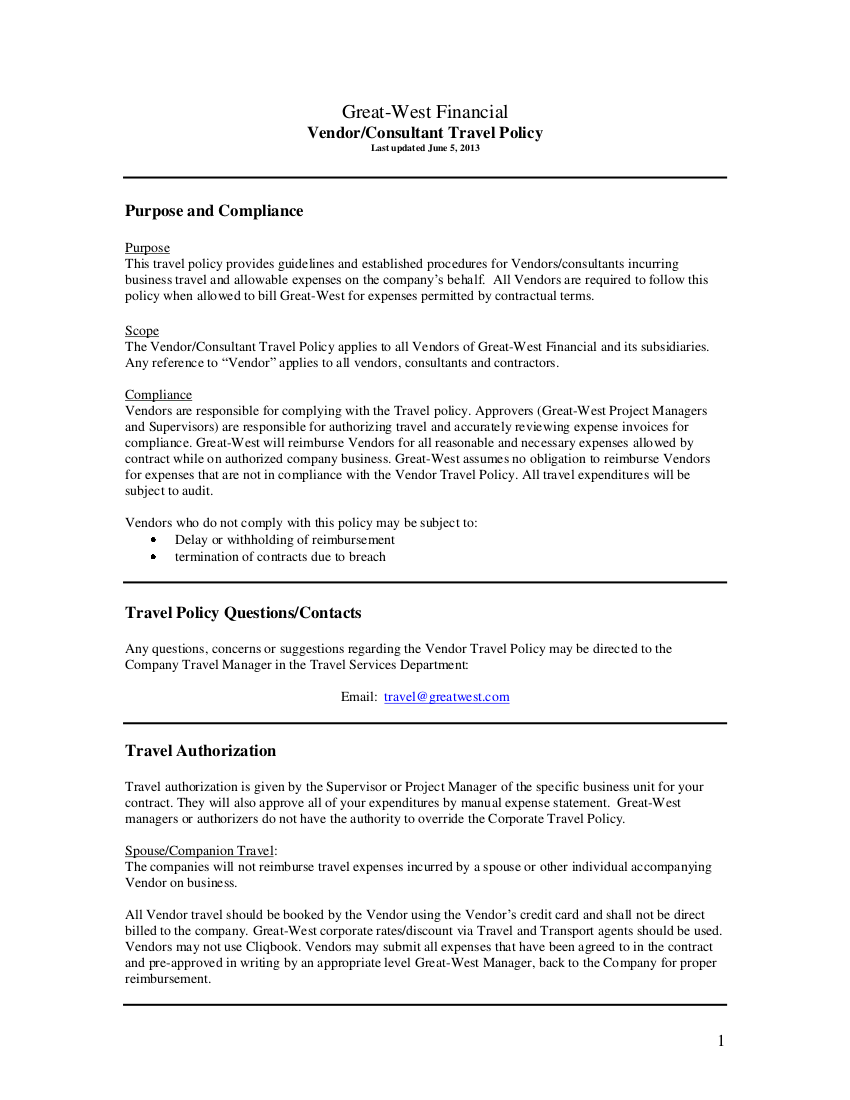

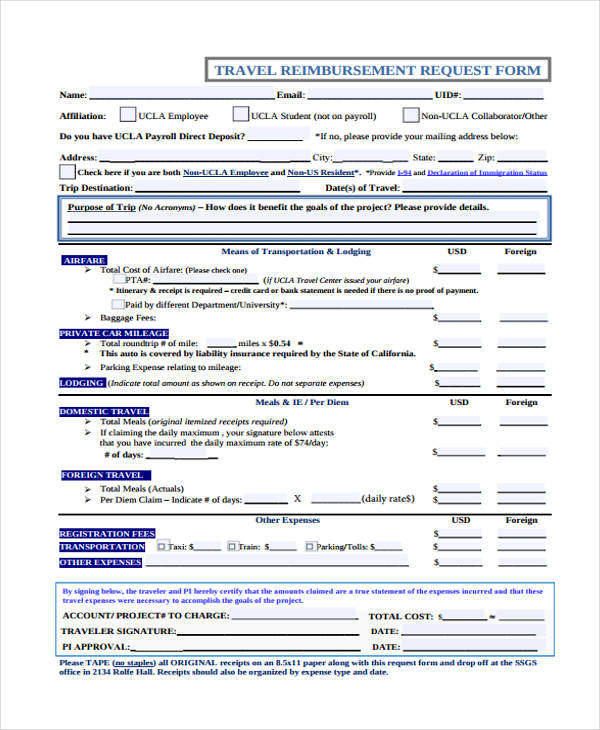

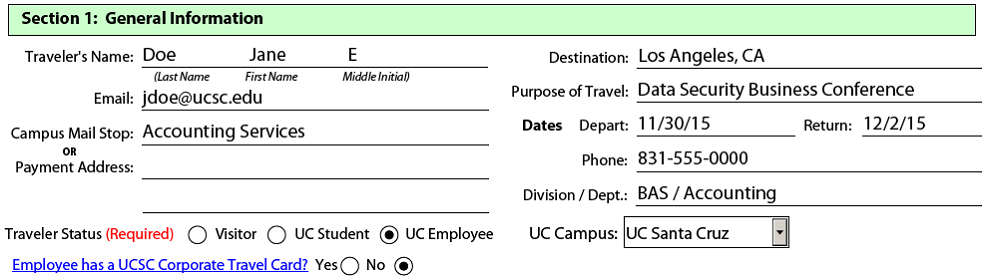

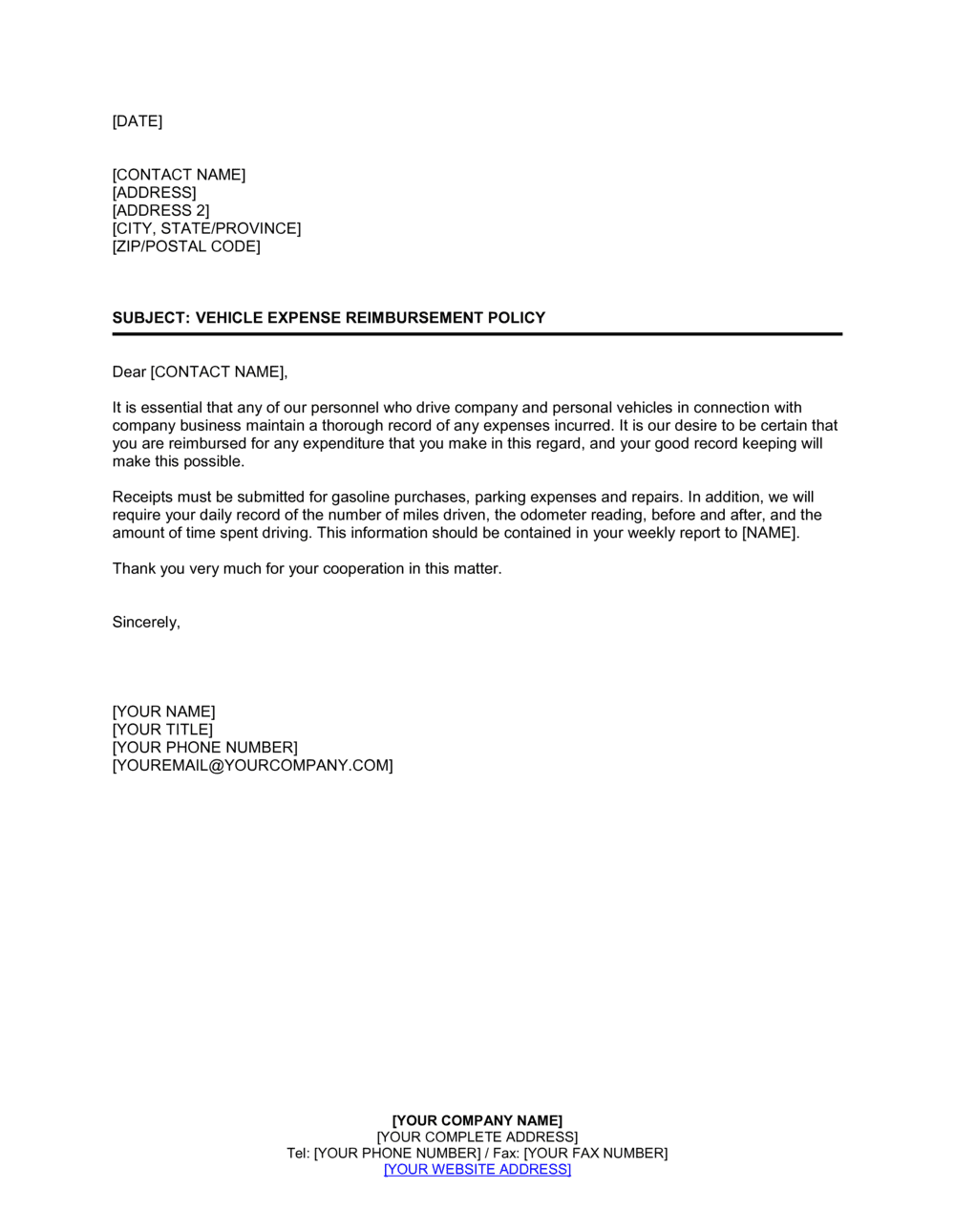

Travel expenses reimbursement email. For travel expenses. This benefit includes special types of transportation like an ambulance ambulette or wheelchair van. I have been out of town for a week this month to perform the companys official audit in karachi. This benefit covers regular transportation like car plane train bus taxi or light rail.

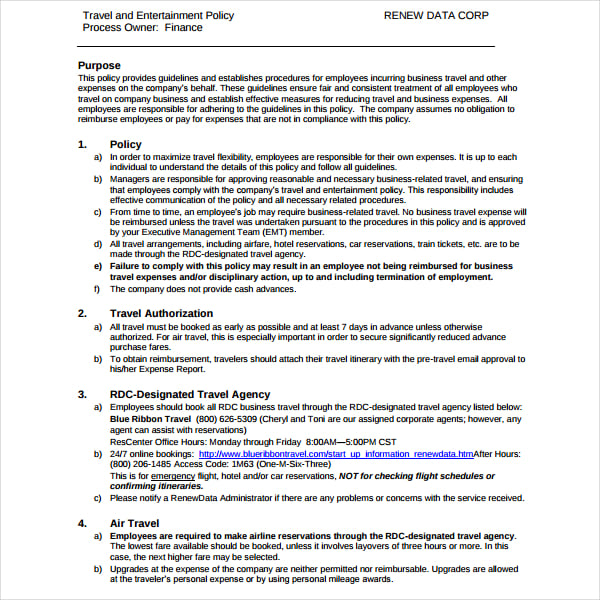

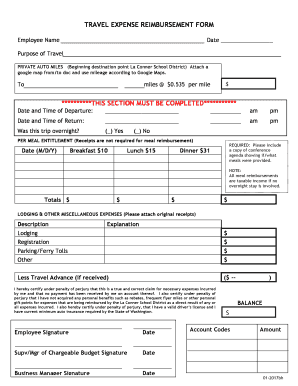

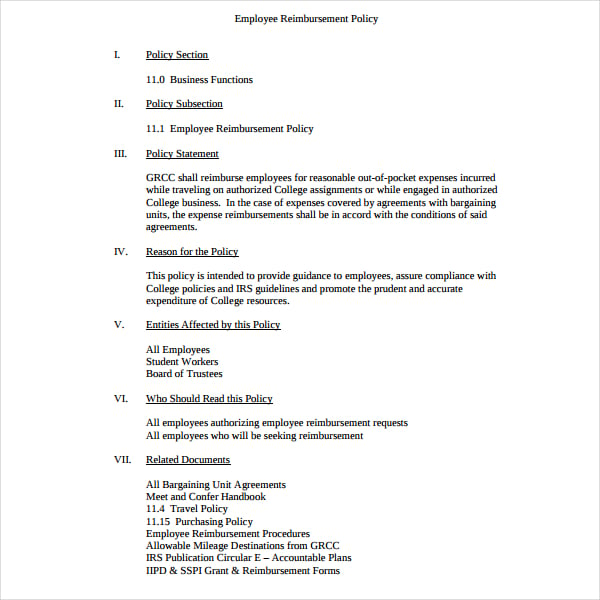

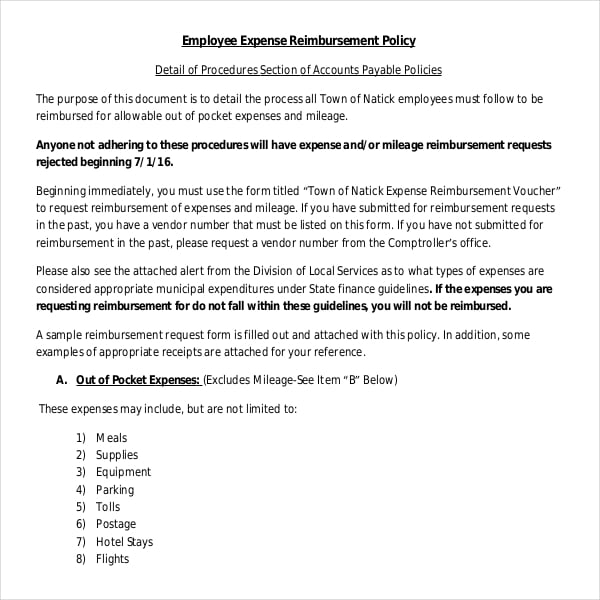

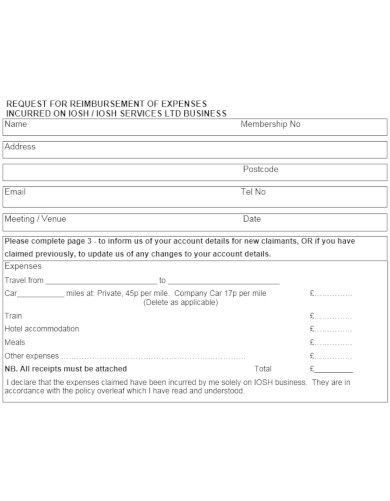

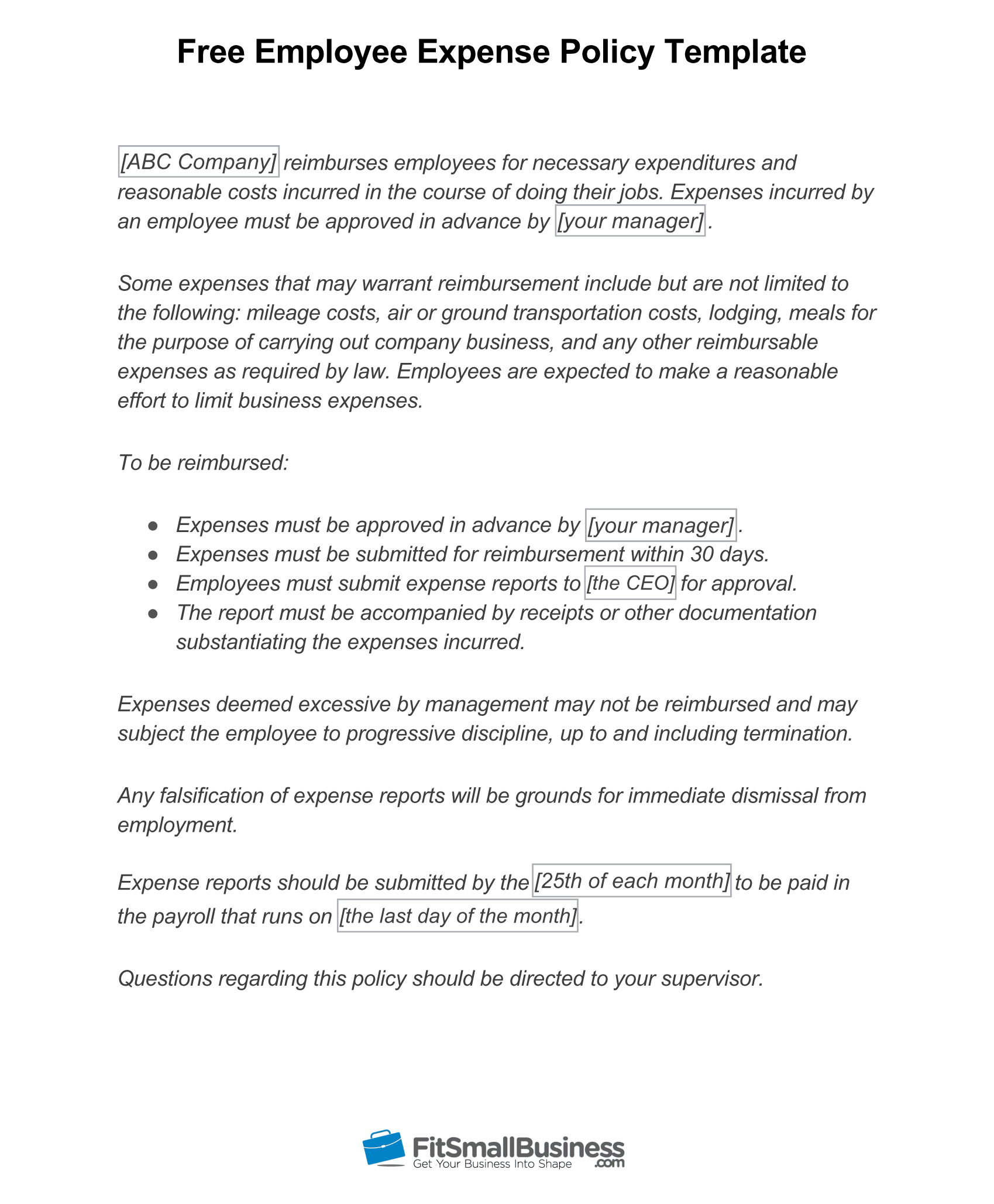

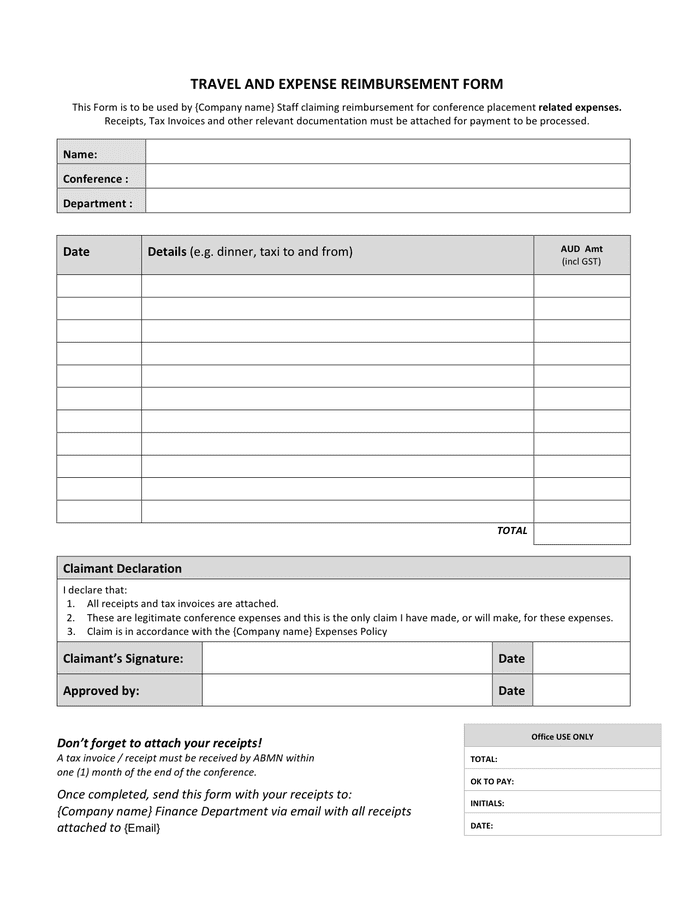

It covers all the relevant information regarding the expenses and the demand of reimbursement. Types of reimbursement va beneficiary travel offers. Employees must file an expense report within 60 days or the per diem becomes taxable wages. Often the employee has to travel to different places for business purpose.

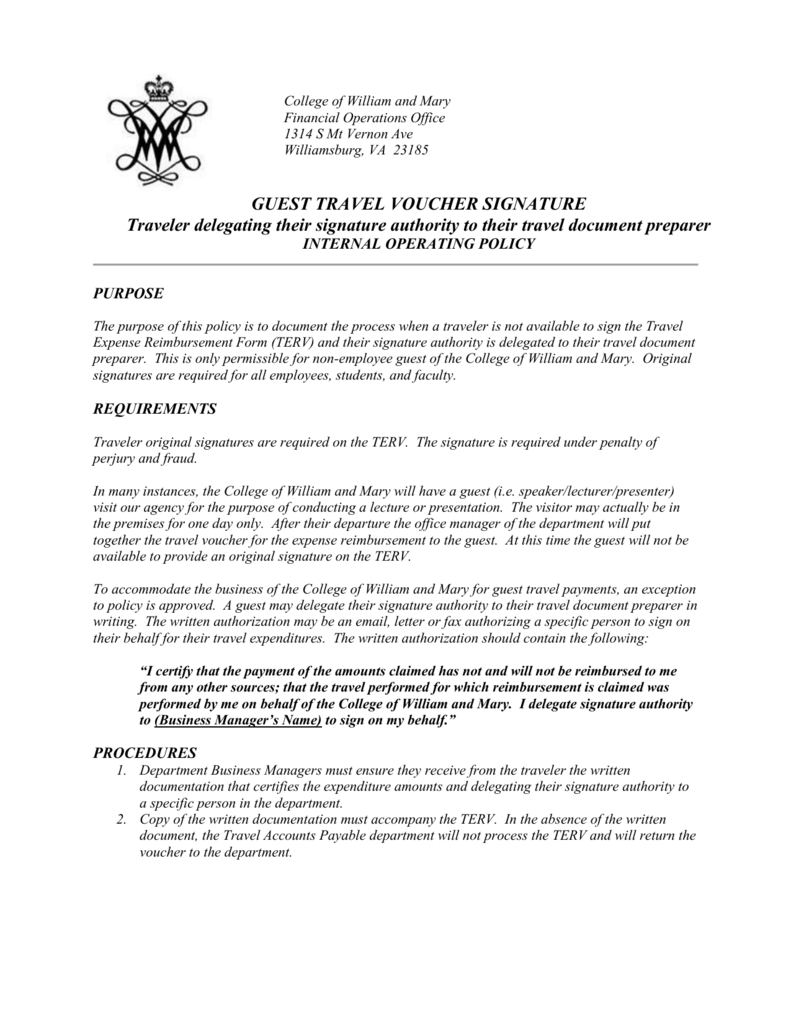

It might be either for finalizing a deal or for any sort of project that the company has taken up. I have never heard of reimbursements for that for an interview small or large company. A verbal claim or an oral complaint can never give you the expected result. The travel entertainment and business expense policies and procedures1 guide provides a convenient source of information regarding the reimbursement of expenses incurred by individuals for university related travel and entertainment and other university business.

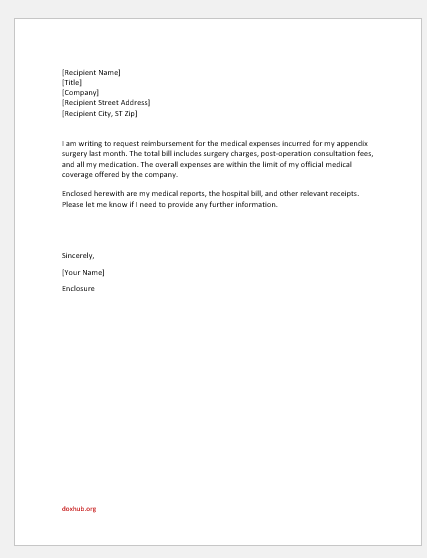

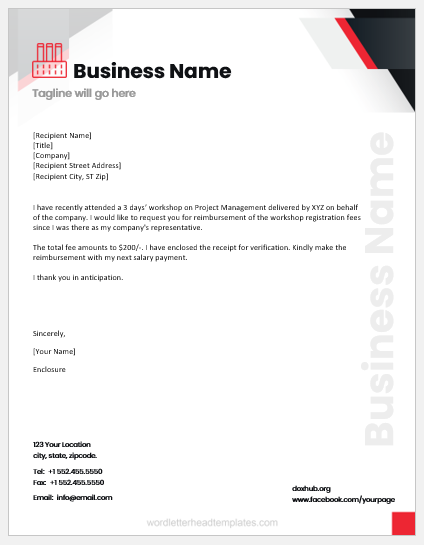

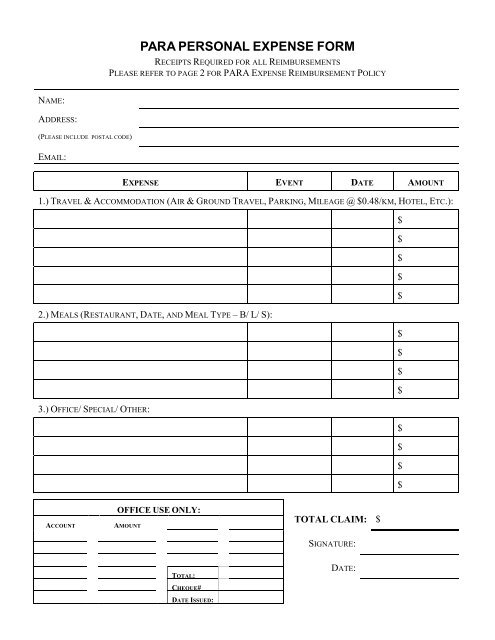

This is a reimbursement request for my business travel expenses. Reimbursement claim letter is an official letter to request the refund of authorized expenses. Asking might get you some really weird looks and possibly cost you the job. I am speaking from a mid west v.

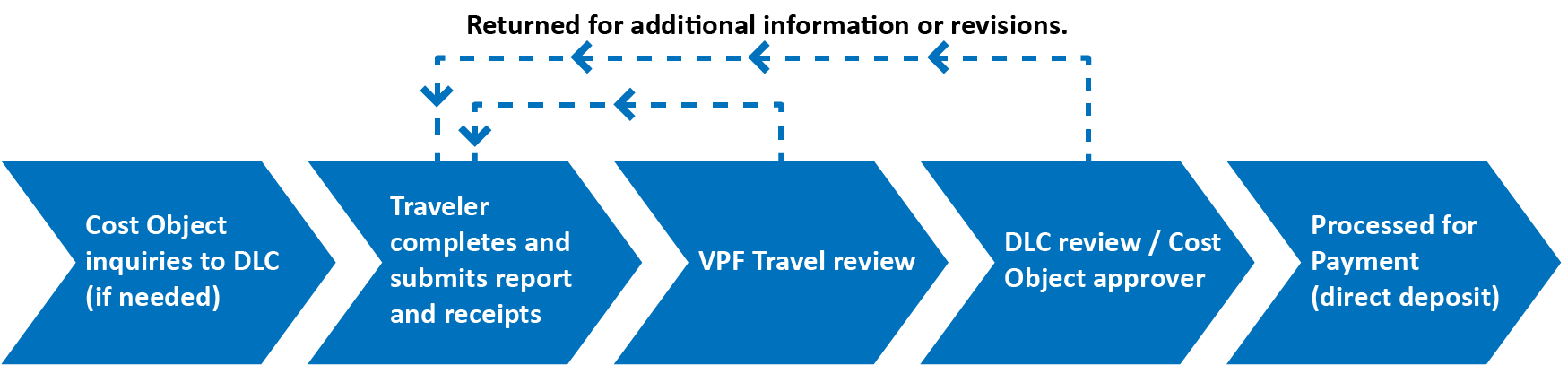

Reimbursement for a business trip letter is written by an employee to his employer to demand reimbursement of the expenses incurred by him on a business related trip. We offer 2 types of travel pay reimbursement for eligible veterans. The report must include the date the trip took place the business purpose and the location of the trip. General health care travel.

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. You cant deduct expenses that are lavish or extravagant or that are for personal purposes. The internal revenue service states that a per diem covers lodging meals and incidental expenses when the employee travels for business. Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary days work and you.

I have attached the necessary documents receipts and bills regarding the expenses incurred during this trip. Are you asking about the taxibussubway fare.

/what-is-per-diem-1918233_V3-bb97d57c5dfc48e3bb3c387ed0869d69.png)

.jpg)