Travel Expenses Reimbursement

And determine whether youre.

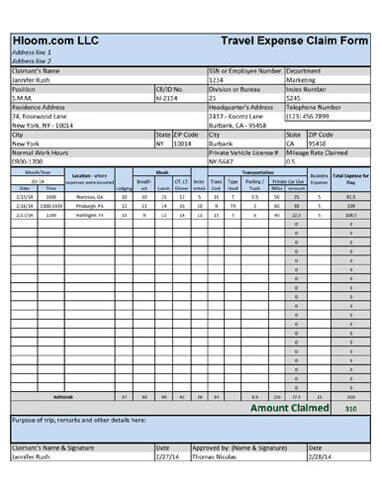

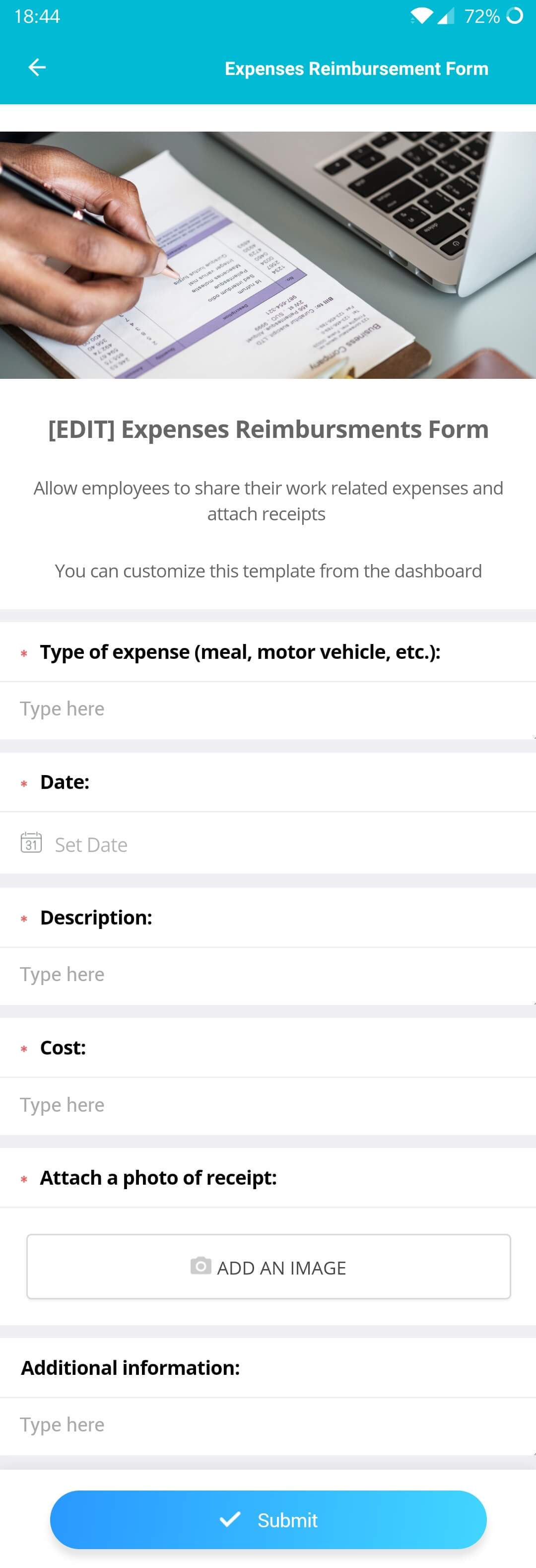

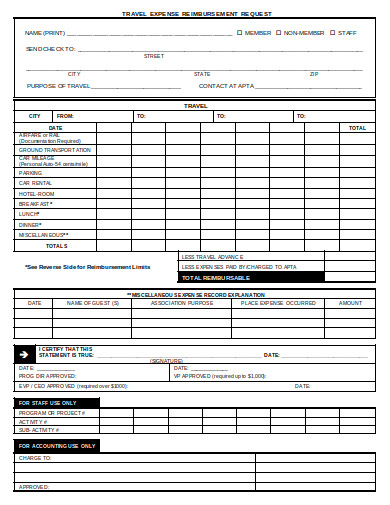

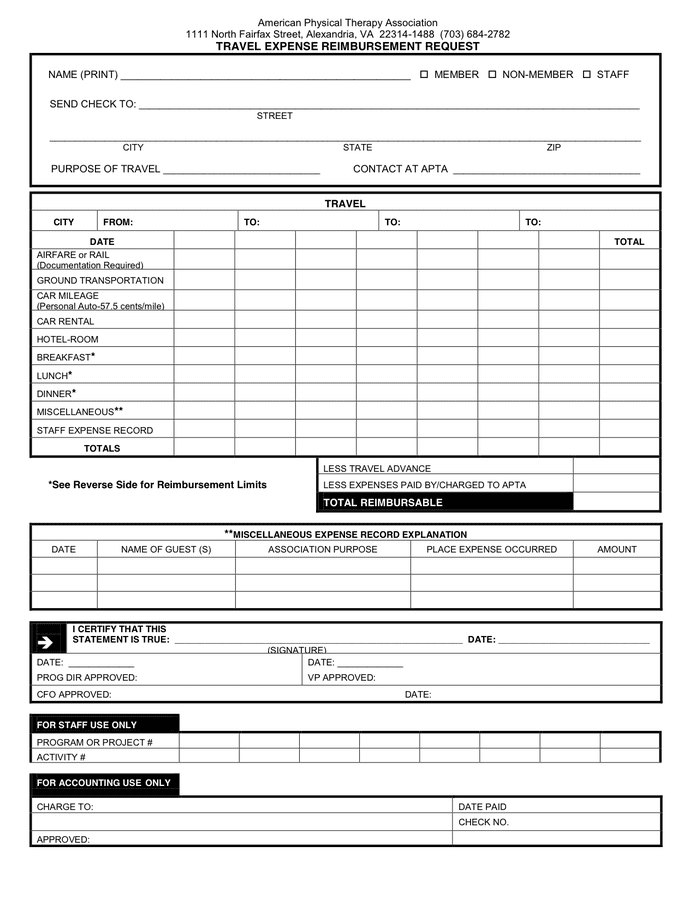

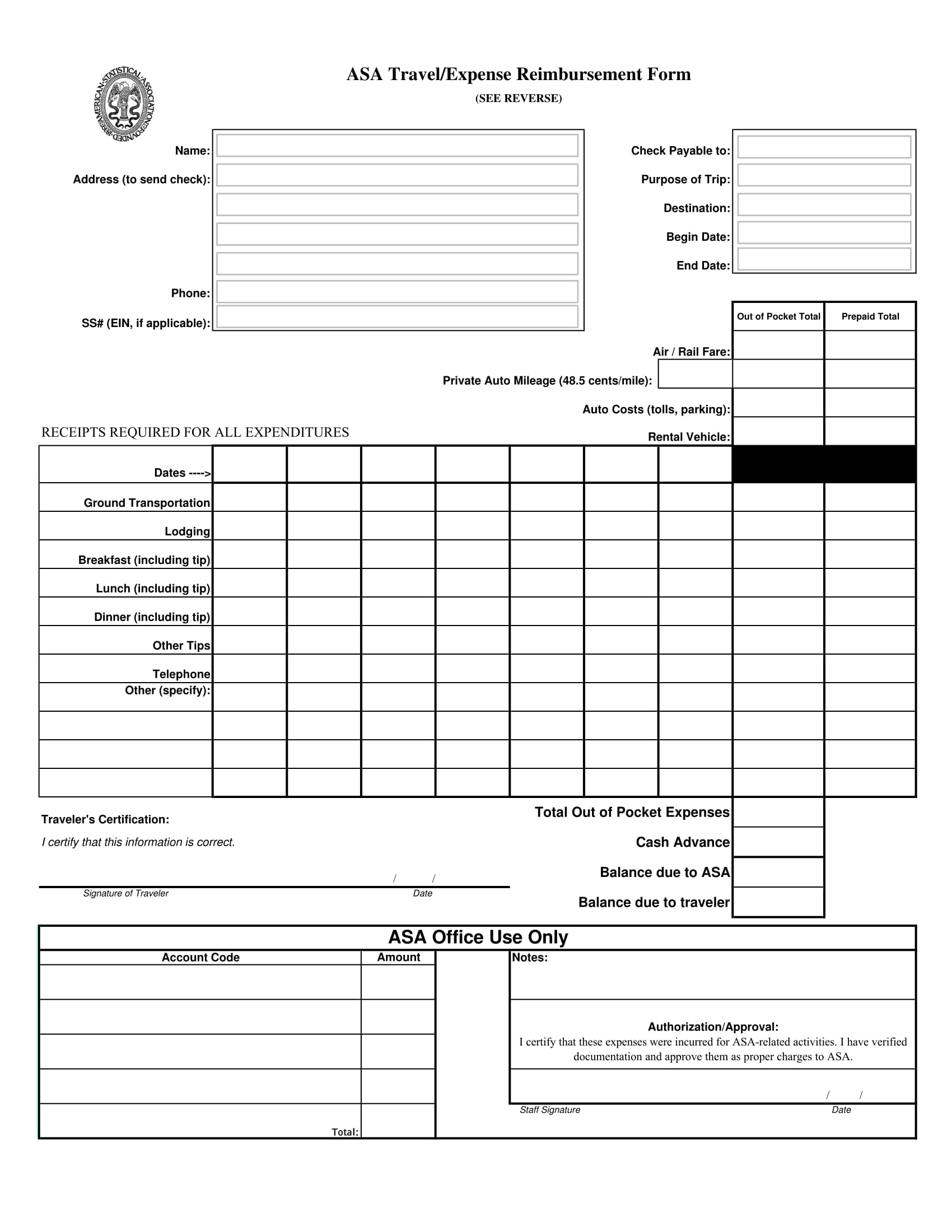

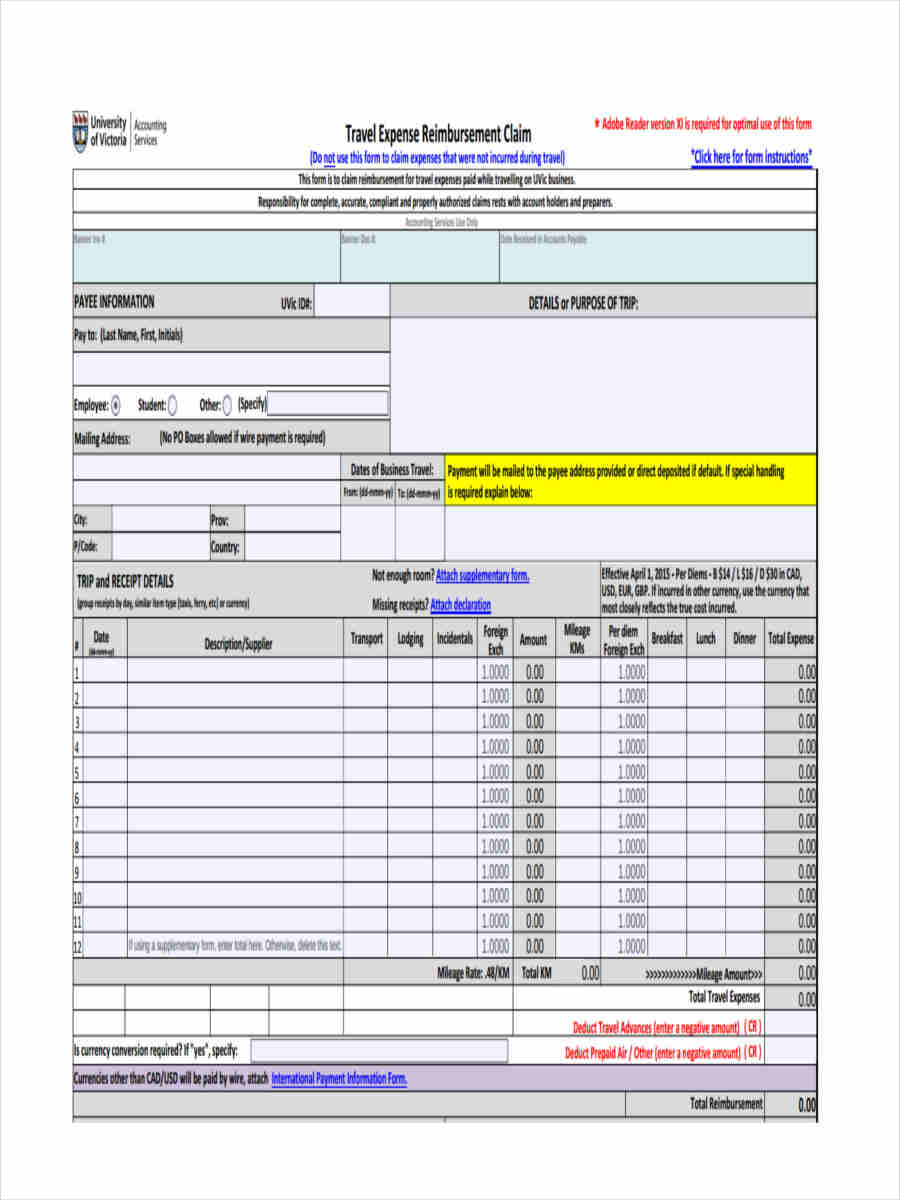

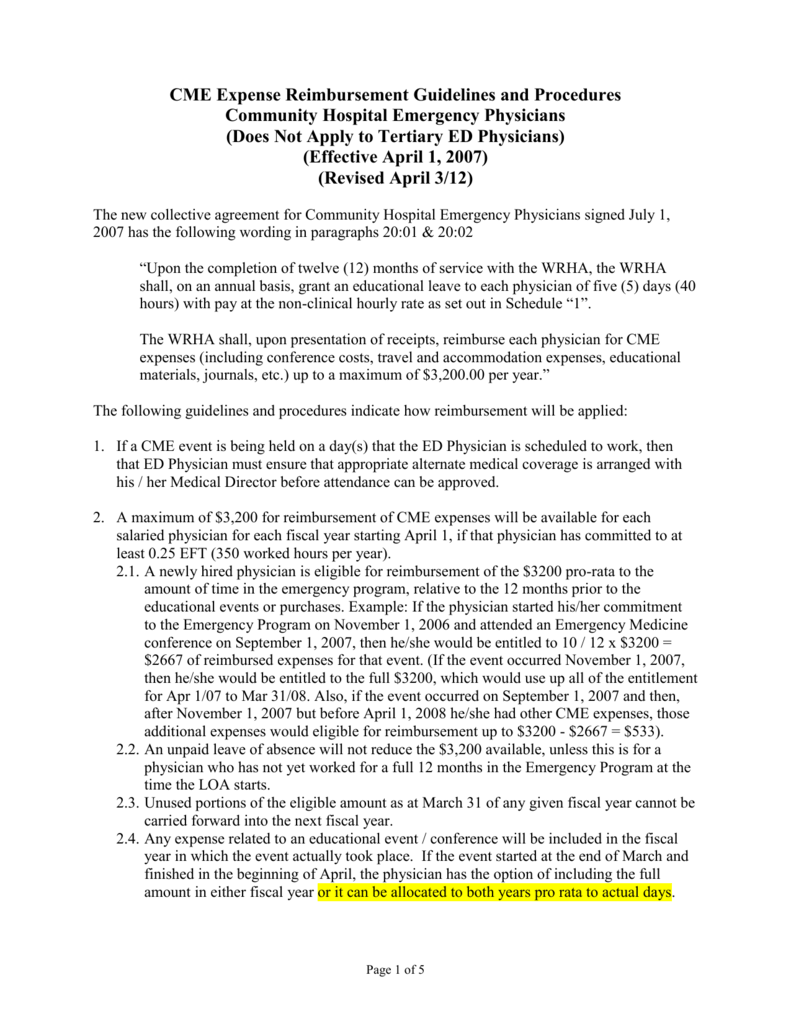

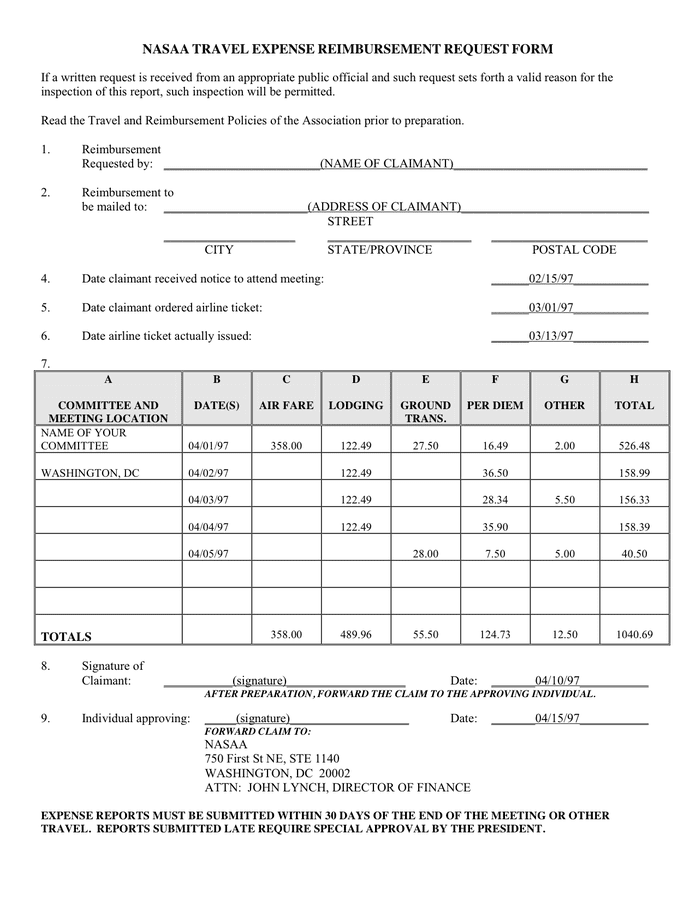

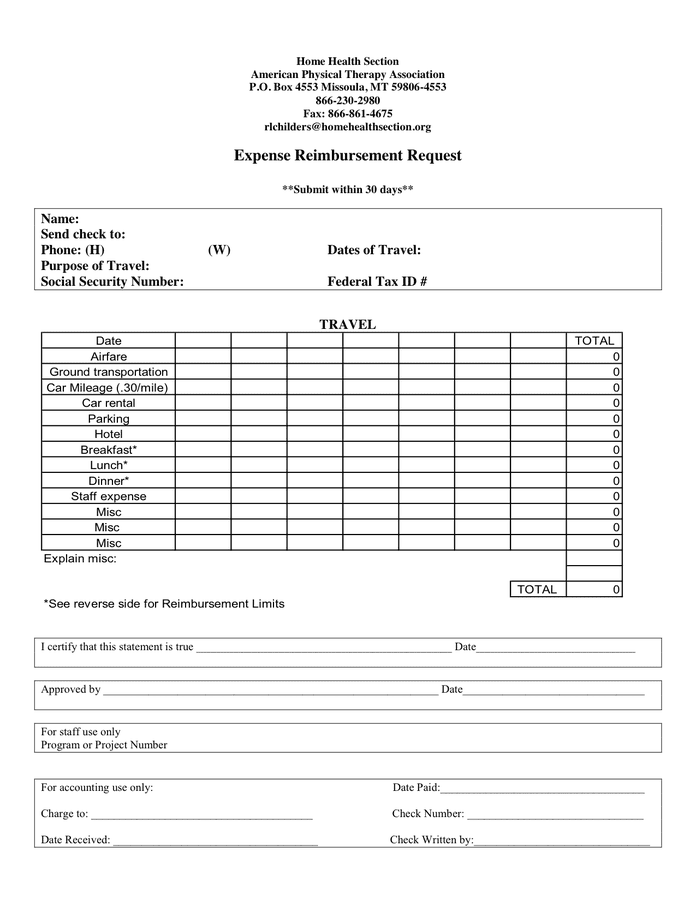

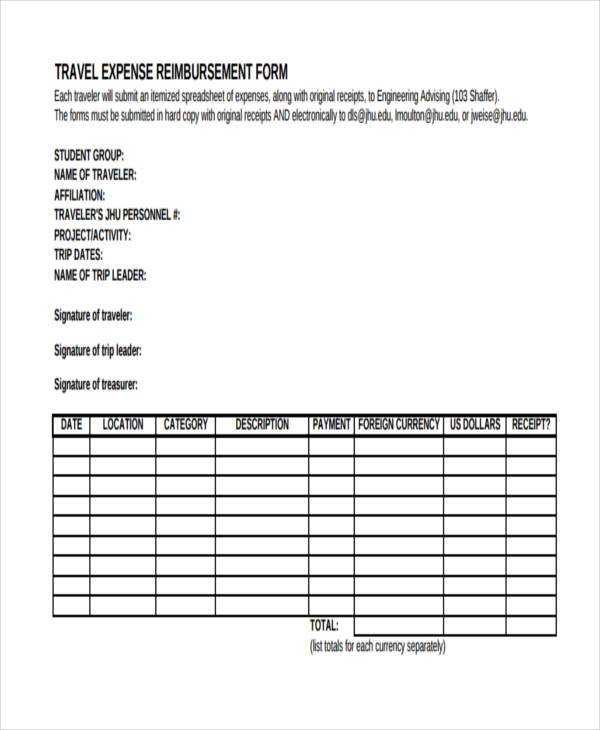

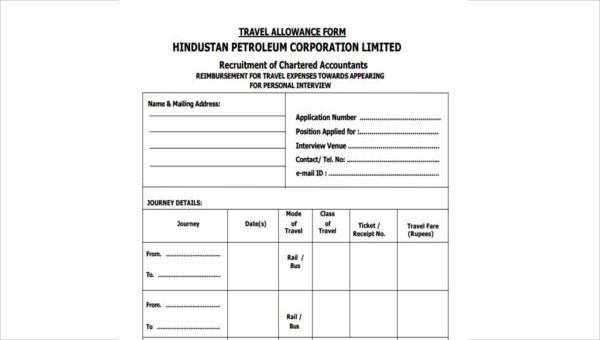

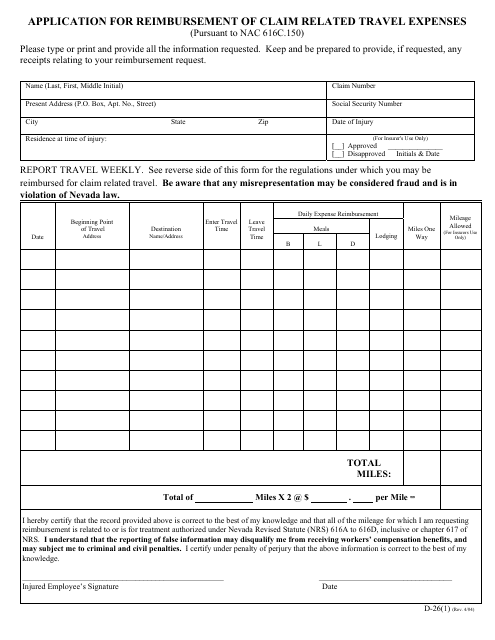

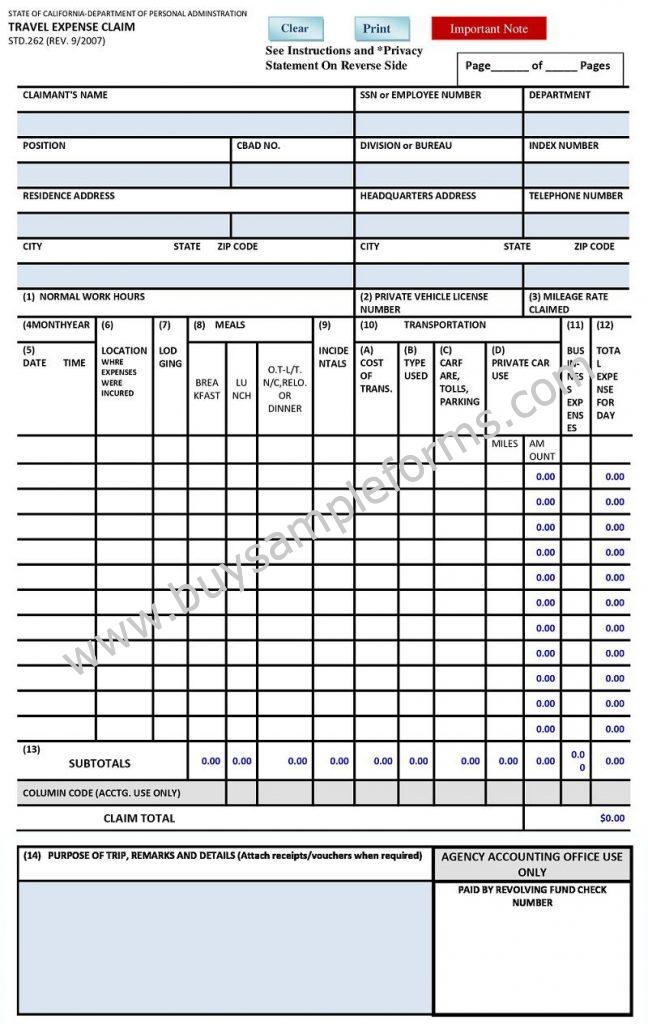

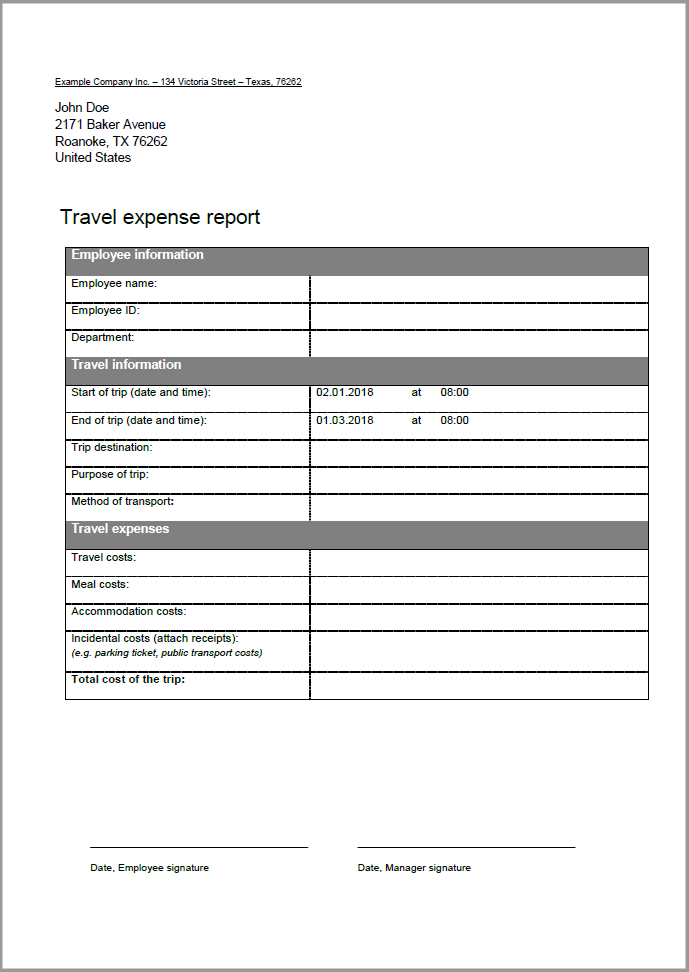

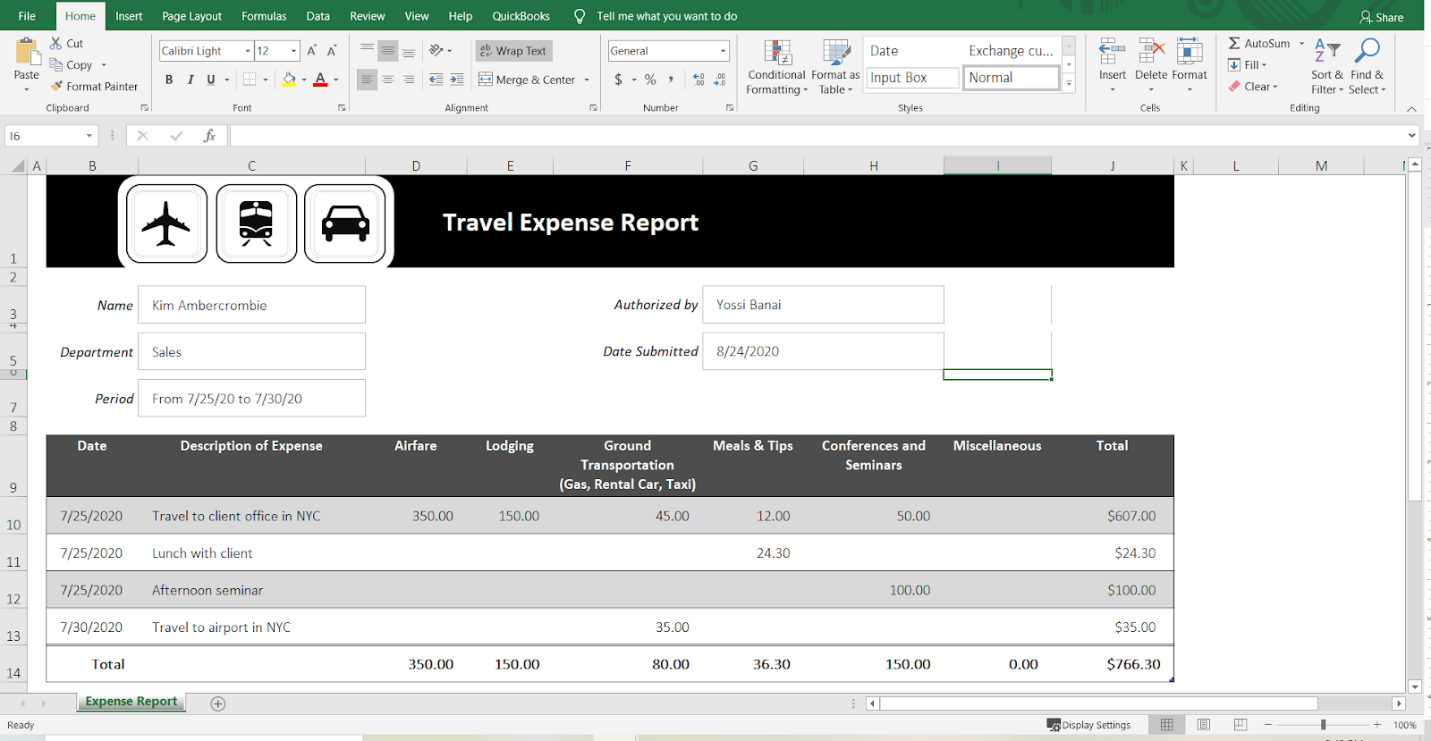

Travel expenses reimbursement. Gather your receipts and track your mileage. Deductible travel expenses while away from home include but arent limited to the costs of. The charitable rate is set by statute and remains unchanged. Travel expense report form.

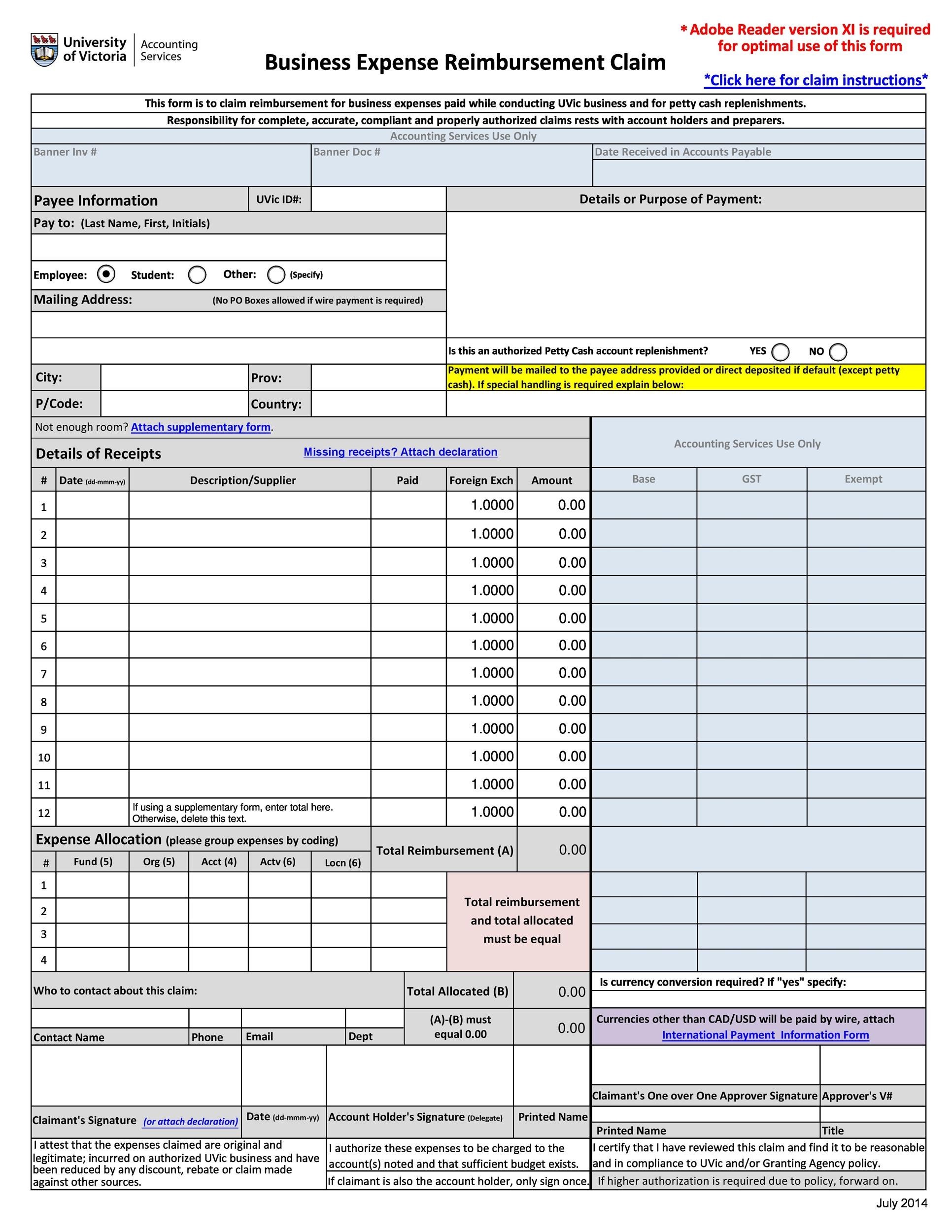

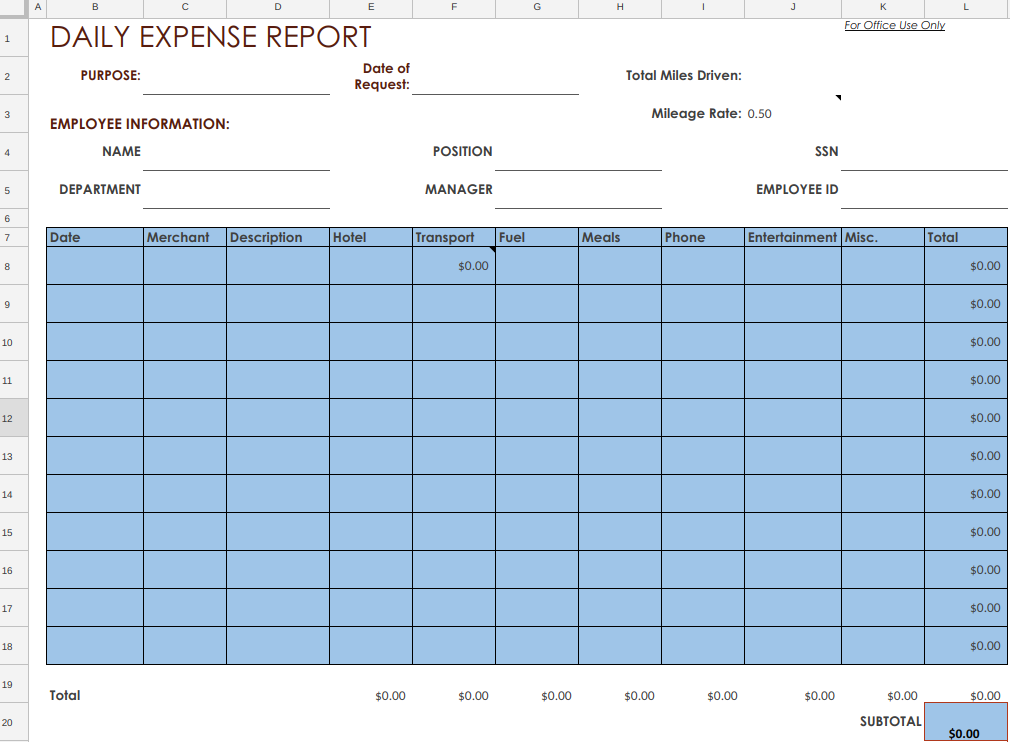

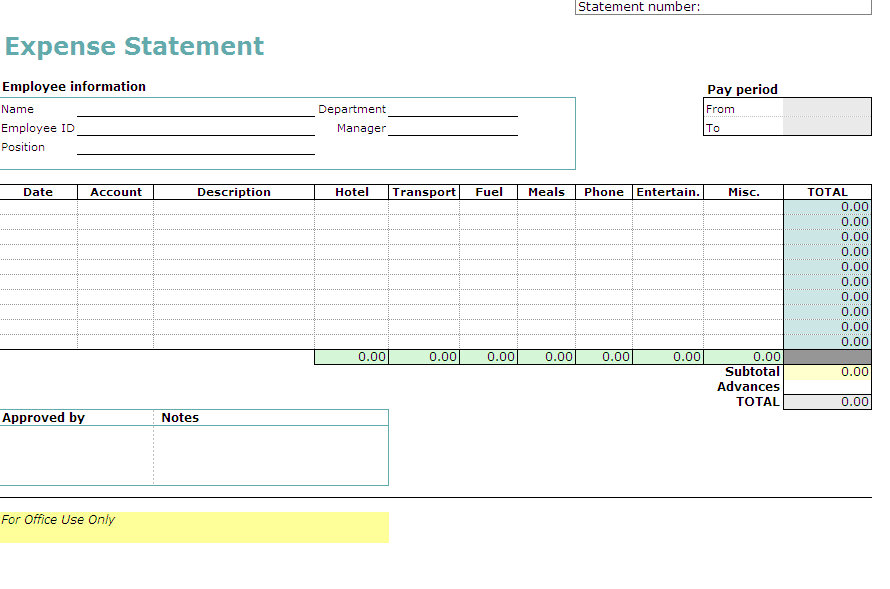

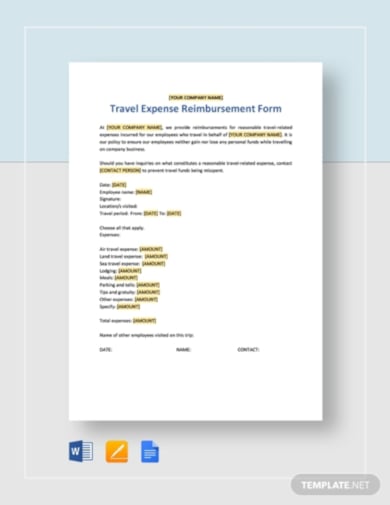

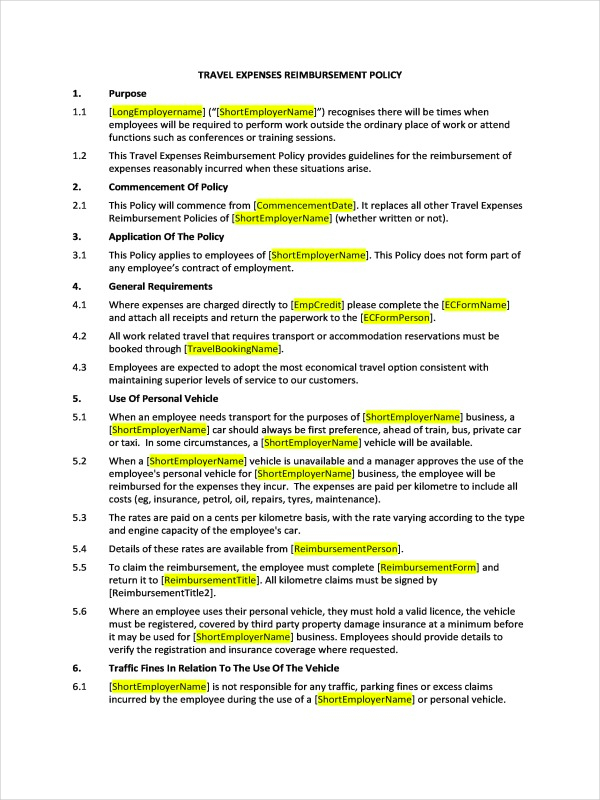

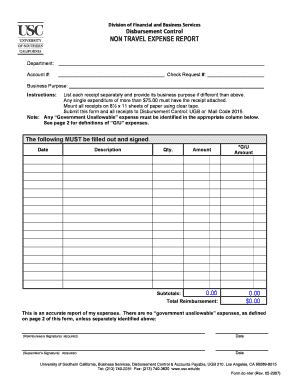

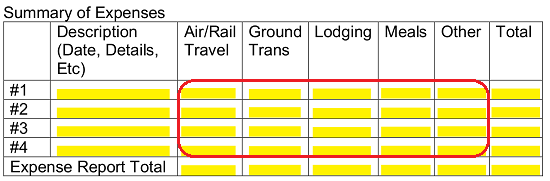

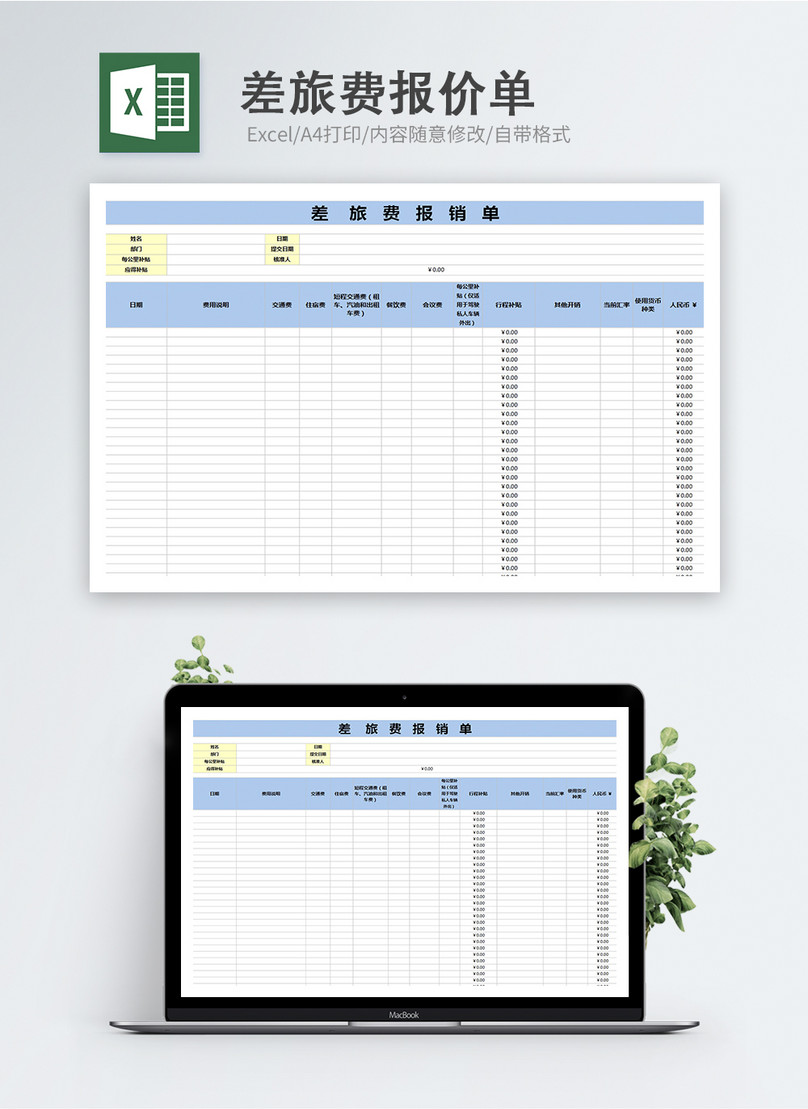

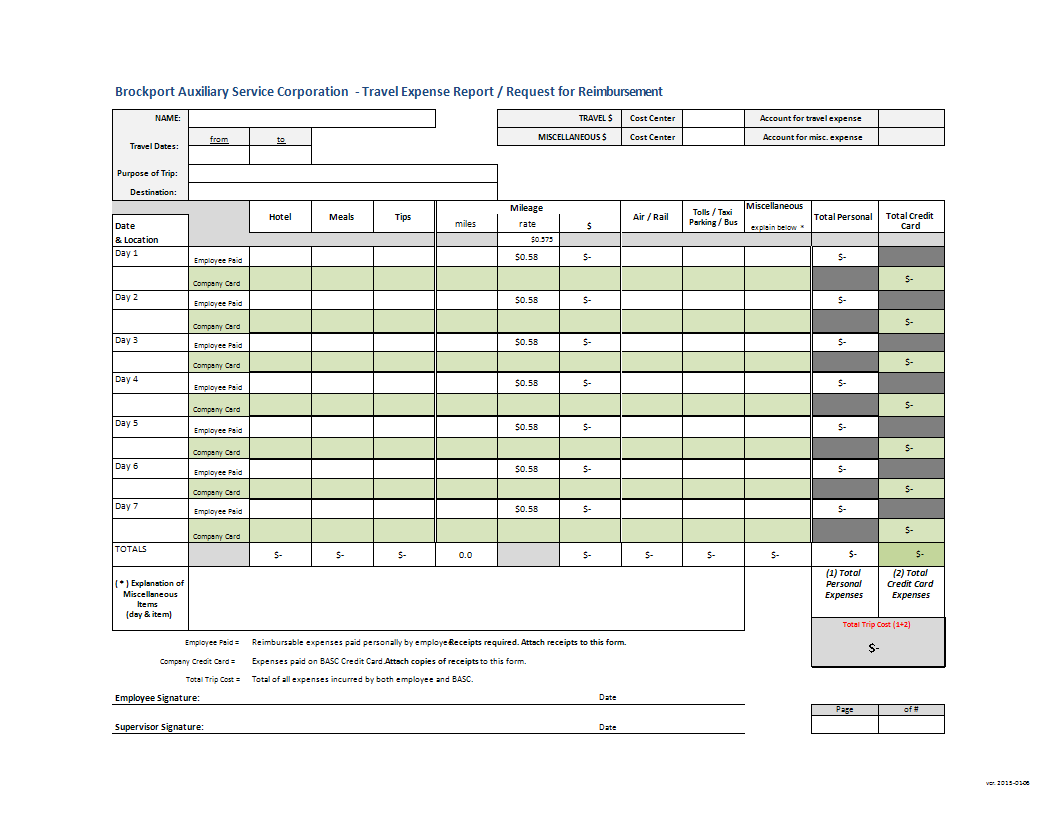

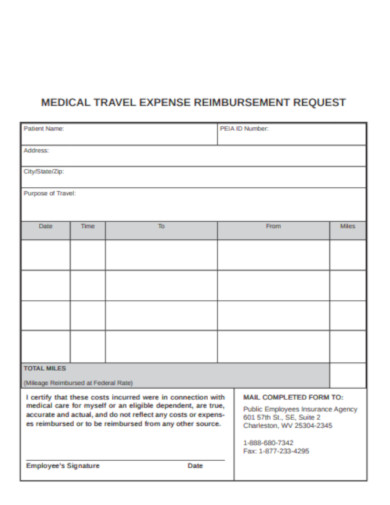

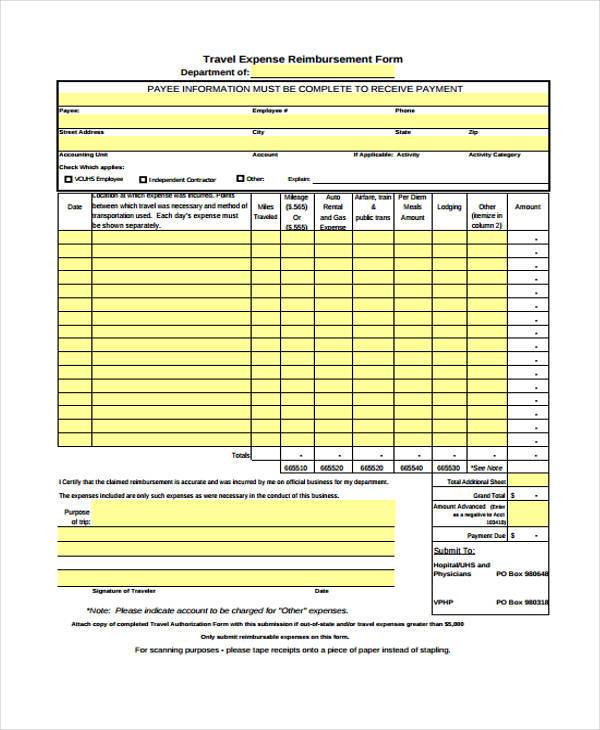

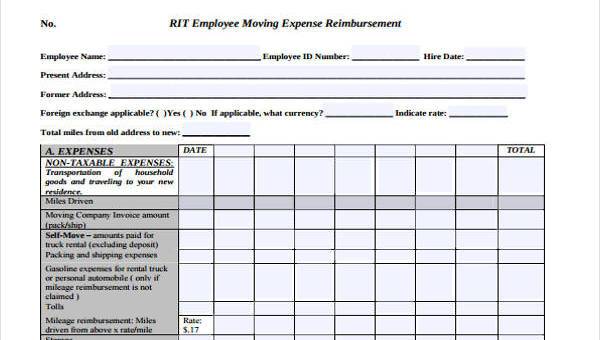

Credit cards are issued to employees who must travel frequently for business. If its commuting its not deductible. Be sure to keep your receipts for all. Employees should complete this expense report template for reimbursement of travel expenses.

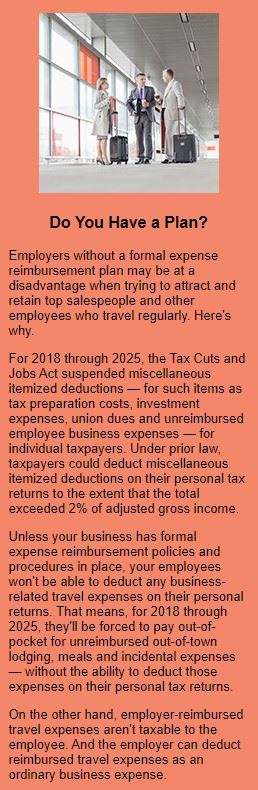

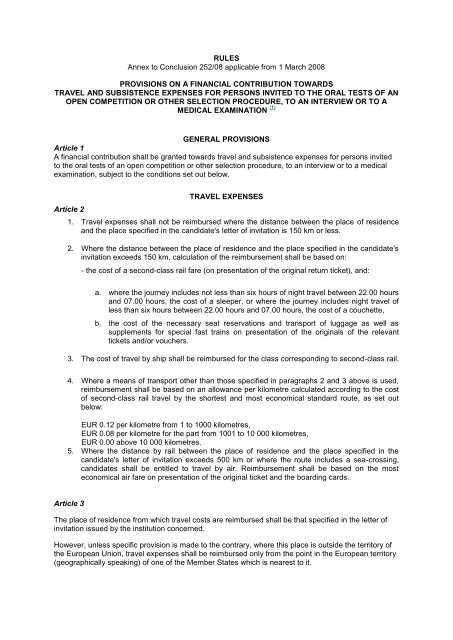

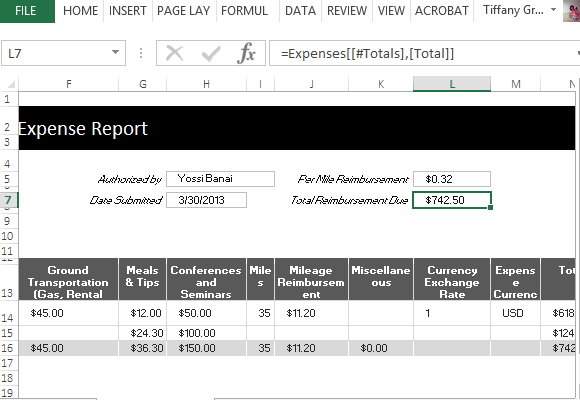

If youre provided with a ticket. If its business travel its deductible as a business expense. The irs makes a distinction between commuting and business travel. Fares rental fees mileage payments and other expenses related to transportation.

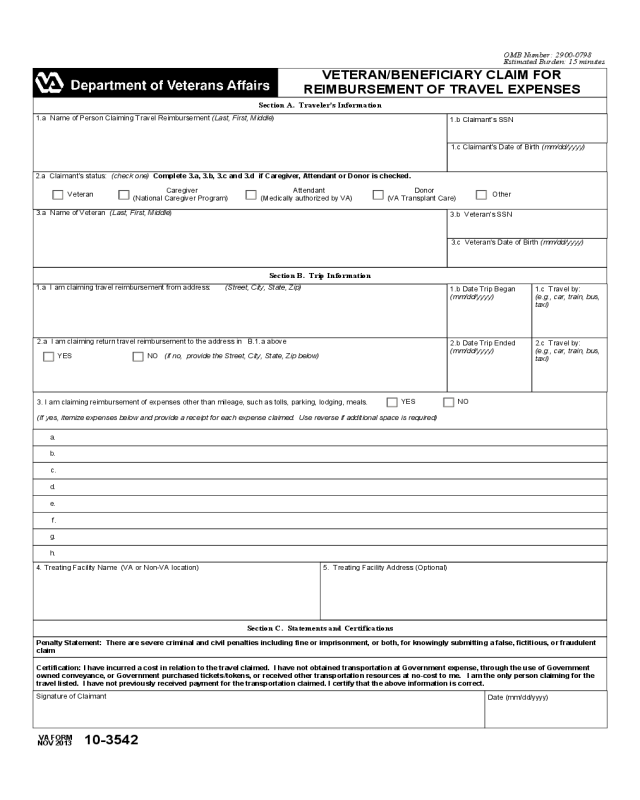

What is business travel. How do i prepare to file a claim for reimbursement. Travel by airplane train bus or car between your home and your business destination. Yes you are eligible for payment of transportation expenses when performing official travel including authorized transportation expenses incurred within the tdy location.

Organizations without employee company credit cards require employees to fill out an expense reimbursement report. You figure the deductible part of your air travel expenses by subtracting 7 18 of the round trip airfare and other expenses you would have had in traveling directly between new york and dublin 1250 7 18 486 from your total expenses in traveling from new york to paris to dublin and back to new york 750 400 700 1850. How do employers pay for employee travel expenses. 14 cents per mile driven in service of charitable organizations.

301 102 what expenses are payable as transportation. The business mileage rate decreased one half of a cent for business travel driven and three cents for medical and certain moving expense from the rates for 2019. Fares for taxis or other types of transportation between. The airport or train.